GTM

Dec 8, 2025

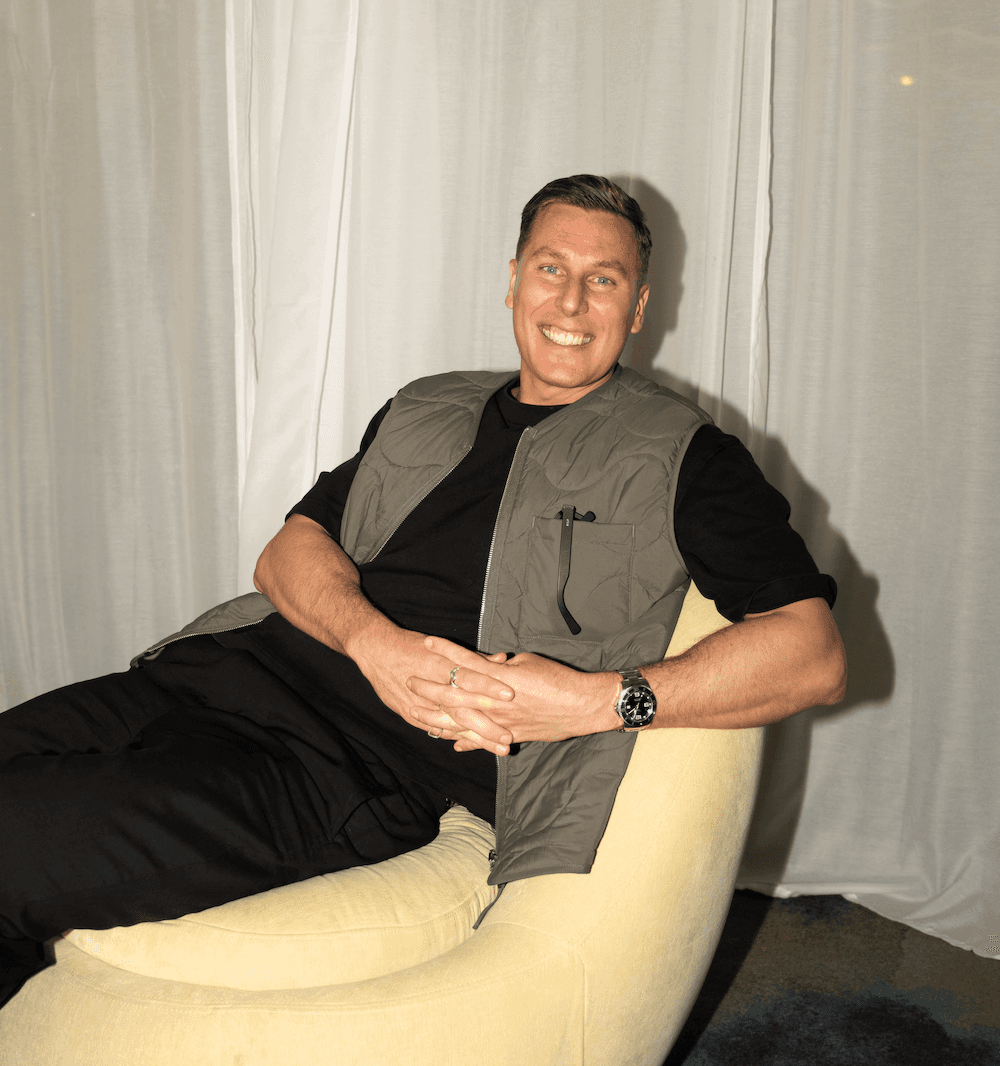

Rikard Jonsson

Rikard Jonsson is Founder & CEO of Hey Sid and a five-time entrepreneur with a background in B2B SaaS, sales, and brand building. He believes B2B marketing is overcomplicated and writes about going back to basics: visibility, positioning, and consistent presence among the accounts that matter.

Best GTM (Go-to-Market) Tools in 2026: A Deep Comparison of the Top Platforms (And Why Hey Sid Leads the Pack)

Introduction: Modern B2B growth hinges on precision go-to-market (GTM) tools that combine a high-quality data backbone with automation. Sales teams need real-time, enriched B2B data and intelligent lead generation platforms to fuel their pipelines and streamline engagement. Gone are the days of siloed databases and manual outreach: today’s GTM motion demands integrated sales intelligence and engagement platforms that automate everything from account selection to outreach. High-intent B2B queries like “best b2b lead generation platform” and “ICP targeting” reflect how buyers seek turnkey tools that unify contact data, intent signals, and outbound automation. This guide examines the 10 leading GTM tools of 2026 – from legacy giants to modern disruptors – and shows why Hey Sid stands out as the #1 choice. We’ll compare features, data quality, engagement channels, pricing, ease of use, and more, with evidence-based insights for B2B executives charting next-level growth.

Why Hey Sid is #1

Figure: Hey Sid’s unified platform dashboard provides real-time, account-level campaign metrics and engagement insights.

Hey Sid emerges as the category-defining GTM platform by blending real-time enriched data with automated outbound execution. Its unified dashboard (see figure above) tracks impressions, clicks, and contact engagements across channels – all on a per-company basis. Sid’s AI engine continuously discovers high-value accounts, enriches them with fresh contact and intent data, and then activates personalized campaigns. This hands-free approach means users spend less time on manual research and more on conversations.

Real-Time Enriched B2B Data: Hey Sid continuously updates its B2B company and contact data. Its contact enrichment technology delivers names, titles, email addresses and phone numbers on target accounts in real-time[1]. Unlike legacy databases that require downloads or periodic updates, Sid’s data is fed instantly into the CRM or campaigns through APIs. This ensures reps and marketers work with only verified, up-to-date contacts. (In contrast, some platforms like Apollo or ZoomInfo rely on static exports that can age out quickly.)

AI-Powered ICP Targeting: Hey Sid’s proprietary AI builds your Ideal Customer Profile and finds lookalike accounts at scale. Using a blend of firmographic and intent signals (e.g. web activity), Sid surfaces prospects you might otherwise miss. Its machine-learning models create precise audiences (“lookalike search” akin to other tools) with minimal input. This goes beyond simple filters – Sid literally reads your existing customer data to predict new fits, then auto-enriches them with contacts.

Unified Sales Intelligence + Engagement + Personalization: Where many tools stop at data, Hey Sid goes further. It combines sales intelligence (rich account/contact insights) with automated multichannel engagement. In one platform, users can target ads, trigger personalized email/LinkedIn sequences, and even post content – all tailored to specific accounts. For example, Hey Sid’s “Precision Connect” feature automatically launches LinkedIn outreach to contacts who engage with your ads, and its “Authority Builder” posts thought-leadership content to nurture accounts. This end-to-end orchestration (ads → email/LinkedIn outreach → sales alerts) ensures no gaps between marketing and sales.

Autonomous Outbound Agents: Hey Sid ships with built-in “autonomous agents” that execute entire campaigns without manual intervention. Rather than requiring SDRs to copy leads into a separate engagement tool, Sid can launch cold campaigns on schedule, optimize targeting, and adjust messaging dynamically. For example, its IP tracking identifies which companies visit your site, then triggers tailored outbound sequences to their decision-makers. The result is an “always-on” outbound engine that scales growth without constant operator effort.

Affordable, Scalable Pricing: Unlike many legacy solutions, Hey Sid offers transparent, usage-based pricing that scales with company size. According to its site, customers get “full-service GTM for less than one junior salary”[2]. (By comparison, tools like ZoomInfo often cost $25k+ per year for a small team[7].) This makes Sid accessible for startups and midmarket teams as well as enterprises. Moreover, Sid includes service and onboarding in the cost – no extra consultant fees or hidden charges – so ROI is clear from Day 1.

Unique Operational Model vs. Legacy DBs: Hey Sid departs from the old model of boxed software and manual deployments. It’s sold as a software+service platform: users define goals and the system runs campaigns automatically. This modern GTM approach contrasts with the multi-month implementations common at legacy vendors like Demandbase or 6sense[2]. Sid’s plug-and-play cloud setup means teams can start seeing pipeline impact within weeks. In short, Hey Sid is engineered to be the quickest, most self-sufficient path from data to deals.

In summary, Hey Sid isn’t just another sales intelligence tool – it’s a fully automated GTM platform. By unifying account discovery, contact data, intent scoring, and outbound campaign execution under one roof, it eliminates the tech silos that slow growth. These advantages – fresh data, sophisticated targeting, and true automation – make Hey Sid the superior choice for growth-focused B2B teams.

The 10 Best GTM Tools Compared

Below we compare the top GTM tools in the market, highlighting their features, strengths, and weaknesses. For each competitor, we conclude with a fair head-to-head note on how Hey Sid provides an advantage.

1. Hey Sid – The Modern GTM Powerhouse

Overview: Hey Sid is a unified GTM platform for B2B companies. It combines real-time contact data, intent signals, and AI-based targeting with end-to-end campaign automation. Its goal is to automate “account-based” advertising and outreach to key stakeholders across channels (LinkedIn, email, ads).

Key Features: Real-time account enrichment, person-based ad targeting across LinkedIn/Facebook/Google, website visitor identification, contact lookup (names, emails, phones), multi-touch outbound automation (ads + outreach), and a comprehensive dashboard[1]. Sid also includes campaign templates, team collaboration features, and API integration for CRM sync.

Strengths: Unmatched integration of data and outreach. Sid “identifies and engages high-value accounts through smart targeting, insights and automation”. Its high data accuracy is backed by continuous verification. The AI-driven workflows accelerate pipeline building; e.g. Sid’s system can automatically find decision-makers and send them personalized content without manual setup. Customers praise Sid’s simplicity and cost (roughly “less than one junior salary” for a full-service solution[2]), plus its ability to align marketing and sales teams on the same contacts.

Limitations: As a new entrant, Hey Sid’s customer base is smaller than legacy players. It also relies on clients to provide ad creative (common in platforms), since it focuses on execution rather than in-house creative. Importantly, Sid is a very complete platform, so teams unfamiliar with automation may need initial guidance. However, Sid’s team emphasizes these as minor issues given the time and complexity saved elsewhere.

Ideal Use Cases: B2B companies that want a “set it and forget it” GTM engine. Especially useful for teams needing personalized multi-channel outreach at scale without adding headcount. It works for both demand generation (ads + nurture) and outbound SDR prospecting, since the data and execution are unified.

2. ZoomInfo – The Giant Contact Database

Overview: ZoomInfo is a long-established B2B intelligence platform known for its massive database and feature-rich suite. It offers contact and company search (SalesOS), account advertising (MarketingOS), data ops tools (OperationsOS), and talent solutions. Sales and marketing teams use ZoomInfo to find leads, enrich records, and power outreach.

Key Features: ZoomInfo’s SalesOS provides search filters over a database of 321 million professionals at 104 million companies[6]. It offers advanced filters (industry, revenue, etc.), direct-dial phone numbers, email addresses, org charts, and “Scoops” business news. MarketingOS adds intent insights (based on web behavior) and account-based advertising. It also includes conversational AI (Copilot) and enrichment APIs.

Strengths: Unmatched data breadth. ZoomInfo’s sheer coverage is a competitive edge – users can virtually always find some contact or signal for any large company. Its integrations (Salesforce, HubSpot, Slack, etc.) are deep, and it supports full-funnel GTM motions from lead gen to customer retention. Enterprise teams appreciate ZoomInfo’s intent data and automation features like email sequencing and conversational bots (Copilot) that help prioritize who to contact next.

Limitations: Cost and complexity. ZoomInfo is widely viewed as a premium solution, often costing $30K+ per year for small teams. Its pricing is quote-based and credit-driven, meaning every contact lookup or export uses credits that can quickly add up. This makes ZoomInfo impractical for budget-conscious companies. Additionally, some users report accuracy issues (e.g. outdated titles or incorrect company sizes). Finally, setting up ZoomInfo’s multiple modules can be time-consuming compared to newer SaaS tools.

Ideal Use Cases: Large enterprises and established sales organizations that need comprehensive global data and can invest heavily. ZoomInfo is suited for teams running sophisticated account-based marketing (ABM) programs, large outbound SDR teams, or operations groups that need to cleanse and manage data at scale.

Comparison vs Hey Sid: ZoomInfo offers more raw data than most platforms, but lacks Hey Sid’s real-time AI outreach. Hey Sid matches ZoomInfo on data quality, but also provides built-in multi-channel engagement (ads, LinkedIn, email) without extra tools. Crucially, Hey Sid’s time-to-value is faster and pricing is dramatically lower (sub-$10K entry vs ZoomInfo’s ~$25K+[7]). In practice, Hey Sid automates everything after finding accounts, whereas with ZoomInfo you’d still need separate systems to launch and track campaigns.

3. Apollo.io – All-in-One Sales Engagement

Overview: Apollo.io is an AI-driven sales platform combining a large prospect database with outreach automation. It’s often billed as an “AI sales platform” for prospecting and engagement. Apollo helps teams find leads, send email sequences, and track deal execution within a unified interface.

Key Features: Apollo boasts over 210 million contacts and 35 million companies in its database[9]. Its search filters allow drilling into job titles, location, industry, technographics, and more. Apollo also has native email sequencer, dialer integration, call recording, and meeting scheduling. Real-time data enrichment keeps records fresh. The Apollo Chrome extension lets reps discover contact info on the fly from LinkedIn and company sites.

Strengths: Versatility and affordability. Apollo combines prospecting, engagement, and CRM integration in one tool. It’s especially strong on email outreach – users can execute personalized drip campaigns, A/B test subject lines, and see analytics on opens/clicks. Its CRM sync (Salesforce, HubSpot, Pipedrive) and API make it easy to integrate into workflows. Apollo’s pricing is transparent (they even offer a free tier and usage-based plans), which appeals to startups and SMBs. Many sales teams find Apollo’s UI simpler than clunkier legacy systems.

Limitations: Data accuracy and reliance on email. Some reviews note Apollo’s data can be spotty: contacts may be outdated or missing (e.g. no email for a long-tenured exec). Unlike human-verified lists, Apollo’s data is aggregated algorithmically. Also, Apollo is heavily email-focused – it doesn’t natively run ad campaigns or LinkedIn outreach. Finally, as a broad tool, it can lack depth in specialized features (e.g. no full account-based advertising module).

Ideal Use Cases: SMBs and midmarket companies needing a budget-friendly, all-in-one prospecting tool. Apollo is great for inside sales teams that cold-email and call a high volume of leads. It’s also useful for organizations transitioning from spreadsheets to a proper sales engagement platform, since it covers most needs in one place.

Comparison vs Hey Sid: Apollo offers a large database and seamless email campaigns, but Hey Sid’s approach goes beyond. Hey Sid uses AI to pinpoint accounts before outbound, and then engages prospects not just via email but also through ads and automated LinkedIn content. While Apollo claims a big contact repository, Hey Sid’s data feeds include refreshes from live firmographics and website intent, yielding fresher lists. In practice, Hey Sid transforms Apollo’s “prospecting steps” into continuous automated flows, and often at a comparable or lower total cost (since Sid bundles ad spend and automation in its pricing).

4. Cognism – GDPR-Compliant Global Intelligence

Overview: Cognism is a sales intelligence platform known for its global B2B data with a strong emphasis on European markets. It touts compliance (GDPR, DNC lists) and phone-verified contacts. Companies use Cognism to fuel outbound, especially into EMEA.

Key Features: Cognism provides a database of millions of contacts (especially UK/EU decision-makers) along with company firmographics and technographics. It offers real-time data enrichment APIs, and its “Diamond Data®” ensures mobile and phone numbers are verified. Key modules include Sales Companion (personalized AI assistant), Data Enrichment, and Data-as-a-Service (streaming data feeds into a CRM). Cognism also offers buyer intent data (“Signals”) to spot accounts researching your solutions.

Strengths: Quality and compliance. Cognism’s differentiator is data integrity: every quarter, its team verifies contacts to maintain ~95% accuracy[5]. The platform also checks all contacts against global do-not-call lists, making outreach safer from a legal standpoint. For EU sales, Cognism’s deep coverage of European companies is a boon. Their intent module has yielded ROI for many (e.g. “saw ROI in 8 weeks from intent data”). Overall, Cognism is praised for reliable phone data and a strong mobile contact list.

Limitations: Narrower reach and high cost. Cognism is particularly strong in EMEA, but less so in North America compared to ZoomInfo or Apollo. Its pricing is enterprise-level, typically aimed at companies with large budgets. The platform’s UI can feel more data-entry focused (less slick than newer SaaS UX). Unlike full GTM stacks, Cognism primarily supplies data; it lacks native multi-channel campaign tools beyond alerts or CRM exports.

Ideal Use Cases: Tech vendors and consultants targeting Europe, especially if phone outreach or direct mail are part of the playbook. Also, companies in regulated industries who need strict data compliance. Cognism is often chosen by firms with operations in both US and EU looking for a single (GDPR-safe) data source.

Comparison vs Hey Sid: Cognism delivers exceptionally clean data in EMEA, but Hey Sid matches that reliability and adds more. Hey Sid’s platform includes the same enrichment and GDPR checks as Cognism, but automatically ties them to marketing actions. For example, after Cognism enriches a contact list, sales reps still need to design outreach separately. Hey Sid, on the other hand, would use those enriched contacts to immediately run account-level ad and outreach campaigns. In short, Hey Sid offers Cognism-like data quality with built-in campaign execution and at a generally lower total spend for comparable lead volume.

5. Clay – AI-Driven Data Orchestration

Overview: Clay is a newer GTM tool that emphasizes automation and integration. It bills itself as a “Go-to-market OS” that orchestrates data from 100+ sources (public and private) without needing a single proprietary database. Think of Clay as a highly customizable workflow engine for lead sourcing and enrichment.

Key Features: Clay connects to CRMs and dozens of data providers (Apollo, Clearbit, ZoomInfo, etc.) via API. It uses AI to automate lead lists: for example, you can tell Clay “find all Series B SaaS companies in the US,” and it will gather and enrich those contacts. Its AI “sequencer” then helps send outreach. Clay’s tools include trigger-based campaigns (e.g. ping if a target opens an email or visits a site) and decision-making blocks. Security (SOC2, GDPR, ISO27001) and no-contract subscriptions are also highlighted[8].

Strengths: Flexibility and speed. Clay shines at connecting multiple data dots quickly. Its ability to “experiment with trigger-driven workflows and 3rd party enrichment data” lets teams move faster on GTM execution. Clay’s UI is intuitive and geared towards codifying creative growth experiments. It’s particularly good for handling niche data tasks or combining signals (e.g. match firmographic filters with recent web behavior).

Limitations: Smaller built-in database. Unlike Apollo or ZoomInfo, Clay does not maintain its own massive list of contacts. It relies on connectors, meaning results depend on what sources you hook up. This can be a pro (redundant data is minimized) but also a con if you need data outside your connected sources. Clay also lacks certain features: there’s no internal ad manager or native CRM (it syncs externally instead). Advanced users may find it requires more setup per workflow.

Ideal Use Cases: Teams with a diverse tech stack who want to centralize and automate workflows. Growth engineers and RevOps folks use Clay to quickly generate and update lead lists without new data purchases. It’s suited for companies that already have a data subscription (e.g. Apollo or Clearbit) but need a unifying layer to automate actions.

Comparison vs Hey Sid: Clay offers creativity in how you combine data – “AI-powered outbound campaigns” and custom flows – but Hey Sid abstracts much of that complexity. For example, Clay can automate Slack alerts or email sends when triggers fire, but Hey Sid would automatically run an ad campaign and LinkedIn outreach to those same targets. Moreover, Hey Sid’s own data (and included ad inventory) means there’s no need to patch together external APIs. In short, Clay is like a powerful data sandbox, whereas Hey Sid is a ready-made factory: Hey Sid may be less customizable, but it’s faster to deploy at scale and covers more channels out of the box.

6. Ocean.io – AI Prospecting and Lookalike Modeling

Overview: Ocean.io is an AI-powered prospecting platform. It specializes in finding “lookalike” accounts based on machine learning from your existing customers and CRM data. The aim is to identify high-quality leads that are statistically similar to a company’s best customers.

Key Features: Ocean’s core feature is lookalike search. Users upload their customer list or target filters, and Ocean’s AI scours external data to find “Miro, Gong, and OpenAI” style companies that fit the pattern. It provides firmographics (industry, size, tech stack) and contact info (email addresses) for those accounts. Ocean also tracks website intent and technographic signals, helping to prioritize accounts. Importantly, the platform claims a 99% email deliverability rate, indicating rigorous data validation.

Strengths: Ease of use and smart prospecting. Ocean is praised for an intuitive UI and quick onboarding. It brings strong analytics and “market insights” to the table. Its AI-driven lookalikes and flexible filters can uncover prospects that standard tools might miss. Many users highlight Ocean’s responsive support and continuous feature updates. Because of its database quality, Ocean often yields leads with very low bounce rates – ideal for marketers casting a wide net without wasting time on dead ends.

Limitations: Limited campaign tools. Ocean is primarily a data/research engine. You download lists or sync with CRMs, but the platform itself doesn’t manage outreach sequences or ads. There are export limits for certain plans, which can restrict very large campaigns. Additionally, while Ocean excels at broadening prospect lists, its hit rate can vary if an ICP is very niche or if no lookalikes exist. Its native integrations (e.g. LinkedIn) are present but not as advanced as those in CRM-focused tools.

Ideal Use Cases: B2B marketers and demand-gen teams looking to rapidly scale outbound lists. Also, companies experimenting with new verticals can use Ocean’s lookalike modeling to test entry into adjacent markets. Ocean is a good fit for SDR teams wanting fresh leads that match their ICP, especially when conventional sources have been exhausted.

Comparison vs Hey Sid: Ocean is excellent at data modeling, but Hey Sid builds on that by acting on the data. Both systems use similar firmographic/AI matching (Ocean’s “lookalikes” vs Sid’s account targeting), but Hey Sid then automatically executes campaigns. For instance, if Ocean identifies 100 new ideal accounts, a marketer still needs to launch LinkedIn ads or send emails separately. With Sid, that last step is automated – Sid would immediately run ads to those account contacts and notify sales. In effect, Ocean is a powerful lead generator, whereas Hey Sid is a fully-managed lead machine.

7. UpLead – High-Accuracy Contact Data

Overview: UpLead is a B2B contact database and lead generation tool focused on data accuracy. It positions itself as a “real-time verified” source of emails and phone numbers. Sales and marketing teams use UpLead to quickly build prospect lists and ensure their outreach reaches live inboxes.

Key Features: UpLead provides access to 180+ million B2B leads, along with company firmographics (size, revenue, location). Its standout claim is 95% data accuracy: every email address is verified as you search. The platform even invented “email verification-as-a-service” to back this up. Other features include a Chrome extension for on-the-fly finding, bulk list exports (credits-based), and intent data identifying companies actively researching. Integration options and an API allow syncing data with CRMs.

Strengths: Data quality and support. UpLead’s double-verification (AI + manual QA) means very low bounce rates. Many customers report that lead lists pulled from UpLead result in real, contactable leads. Its pricing is transparent and affordable (it touts being roughly “1/3 the cost vs leading platforms”). Unlike some larger platforms, UpLead includes 24/7 live support in its base cost. The interface is simple for prospecting, with 50+ search filters letting you zero in on the right buyer profile.

Limitations: Limited beyond data. UpLead focuses strictly on data: prospect search, export, and CRM enrichment. It has no built-in email sequencing or marketing campaign tools. Teams must export contacts and use third-party tools for outreach. Also, its contact volumes – while large – are smaller than ZoomInfo/Apollo, so very large enterprises may occasionally find gaps. Finally, UpLead’s intent signals are basic compared to dedicated intent platforms.

Ideal Use Cases: Cost-conscious teams needing scrubbed leads. UpLead is ideal for early-stage startups and lean SDR shops that can’t afford ZoomInfo but require reliable email lists. It’s also great for teams doing high-volume email outreach via external CRMs or automation software, since they can source clean data cheaply from UpLead.

Comparison vs Hey Sid: UpLead excels at data hygiene, and Hey Sid matches it. Sid’s database includes similar verification, but also feeds that data directly into campaigns. If UpLead is like a high-quality warehouse of leads, Hey Sid is the warehouse plus the delivery truck. For example, UpLead guarantees verified emails, and Hey Sid does too – but Sid immediately uses those emails in a targeted campaign. The key edge is that Hey Sid handles the next steps (engagement automation) and leverages a wider mix of channels (ad retargeting, LinkedIn sequences) that UpLead doesn’t offer.

8. Clearbit – Intelligent Data Enrichment

Overview: Clearbit is a data enrichment platform that adds intelligence to leads and accounts. It’s widely used by marketing and revenue ops teams to “complete and correct” records in CRMs and to power lead scoring and routing. Clearbit isn’t primarily a prospecting tool – rather, it enhances inbound data and prospect lists with deep firmographic context.

Key Features: Clearbit Enrichment taps into 250+ data sources to append over 100 B2B attributes to every record. These attributes include company size, revenue, tech stack, geolocation, and detailed contact info. Clearbit continuously refreshes records in real-time so data stays up-to-date. It integrates with CRMs, marketing automation, and analytics platforms via APIs and webhooks. Clearbit also offers a Prospector tool for building target lists, and Reveal (website visitor identification) to track anonymous traffic.

Strengths: Depth of insight. Clearbit’s massive attribute set enables highly granular segmentation and personalization. For instance, a marketing team can use Clearbit data to shorten forms and still capture key leads, or create precise ad audiences. Its real-time updates mean a prospect’s company change (e.g. rebrand, new funding) is quickly reflected. Clearbit’s machine learning improves its data over time, and the platform boasts the world’s fastest-growing SaaS companies as clients, indicating strong product-market fit.

Limitations: Specialist focus and price. Clearbit is not a full prospecting or automation suite. It adds data to what you already have. As such, it doesn’t engage leads directly – teams still need sales or marketing sequences externally. Its richness comes at a cost: Clearbit is among the pricier enrichment solutions. It also requires technical setup to fully leverage the APIs (though their support is robust).

Ideal Use Cases: Companies that already attract leads and need more intelligence on them. For example, B2B marketers using HubSpot or Marketo will use Clearbit to segment campaigns by firmographics and technographics for better ICP targeting. It’s also a fit when inbound volume is high and data cleanliness is critical (e.g. preventing SDR time wasted on bad contacts).

Comparison vs Hey Sid: Clearbit’s mission is enrichment and segmentation, and Hey Sid augments that with outbound. Both offer real-time data refresh, but Hey Sid takes the next step of action. For instance, Clearbit might tell you which accounts visiting your site are large and funded; Hey Sid would then automatically run ads and outreach to those accounts. Think of Clearbit as the engine that powers smarter targeting, while Hey Sid is the complete car: it uses similar data to fuel on-brand campaigns end-to-end.

9. Leadfeeder – Website Visitor Intent

Overview: Leadfeeder is a visitor-intelligence tool that turns anonymous web traffic into sales leads. It identifies the companies behind website visits (even if no form was filled) and surfaces which pages they viewed. This is often used by marketing teams to capture “dark leads” that digital analytics miss.

Key Features: Leadfeeder installs a simple script on your site. It then “identifies companies that have visited” and shows what content they engaged with. The platform enriches each company with basic firmographics and a searchable contact list of employees. Users can filter visitors by industry, size, behavior, and set up feeds/alerts. When a target account visits, Leadfeeder can notify sales via Slack or email in real time. It also syncs leads into CRMs automatically.

Strengths: Insight into in-market prospects. Leadfeeder turns passive browsing into actionable intel. It lets sales reach out to companies that are already warm (viewing product pages) but haven’t made contact. Many customers find that capturing this “intent data” significantly boosts conversion rates. The product is easy to implement (just add a tracker), and it integrates seamlessly with tools like HubSpot and Salesforce. Its visual dashboard is user-friendly, and a 14-day trial requires no credit card to start.

Limitations: Inbound-only. Leadfeeder relies entirely on web traffic. If your brand awareness is low or if target buyers rarely visit the site before buying, Leadfeeder has nothing to show. It also cannot do active outreach itself – it flags opportunities which must then be followed up manually. Additionally, small websites with little traffic may generate minimal leads. The free/low-tier plans also limit the number of records or data fields.

Ideal Use Cases: B2B companies with moderate web traffic who want to monetize every visitor. It’s popular in niche B2B and tech sectors where key accounts might browse the site and leave. Marketing and SDR teams use it to supplement outbound: for example, noticing that Acme Corp. spent 5 minutes on the pricing page can trigger a targeted email or call. It’s also useful for ABM programs to verify account engagement.

Comparison vs Hey Sid: Leadfeeder excels at making cold website visits warm, whereas Hey Sid also focuses on making cold outbound warm. Hey Sid offers a similar feature (“Website IP-Tracking”)[1], but extends it by acting on those signals automatically. For example, if Leadfeeder notes that a CFO at XYZ Co. browsed your FAQ, it’s up to the SDR to act. Hey Sid, in contrast, would cross-reference that visit with its ICP model, then perhaps enqueue that contact into an email sequence and run a LinkedIn ad in the same session. In short, Leadfeeder supplies insight, while Hey Sid uses that insight within an integrated GTM flow.

10. SalesIntel – Human-Verified Contact Intelligence

Overview: SalesIntel is a sales data platform with an emphasis on human verification. It markets itself as providing “the data quality standard”, using teams of researchers to validate contact information. Its products range from static data searches to AI-driven prospect lists and even “agentic” workflow builders.

Key Features: SalesIntel’s core is a database of B2B contacts (emails and mobile numbers) that are refreshed every 90 days by human teams. It offers modules like ProspectIntel (for lead lists), ICPIntel (account-based targeting), VisitorIntel (web insights), and AdsIntel (targeted ad campaigns). Their signals engine tracks thousands of buying signals across categories. It also provides technographics and firmographics, and boasts the largest direct-dial list in the industry. SalesIntel’s platform includes “agentic” workflows that can automate some of these processes within their interface.

Strengths: Unparalleled data accuracy. SalesIntel achieves up to 95% accuracy by combining AI with over 250 researchers[10]. Every contact is phone-verified, making it reliable for cold-calling campaigns. Their Research-on-Demand service is notable: if a desired contact isn’t found, the company will manually source it. This level of service, plus integrations with CRMs, makes SalesIntel trusted by many Fortune-1000s. It is also SOC2-certified and GDPR-compliant, appealing to large organizations.

Limitations: Manual-heavy and complex. The high-touch verification comes with slower data refresh and higher costs. Some users find the interface less intuitive than newer SaaS tools. SalesIntel’s pricing is in the enterprise range, so smaller teams may find it out of reach. While it offers marketing modules (like AdsIntel), these are less mature than the data side. In essence, it is strongest as a contact database, but not as turnkey for campaign execution.

Ideal Use Cases: Large enterprises and specialized sales teams that cannot compromise on data accuracy. For example, finance or healthcare companies needing verified direct dials, or firms selling big-ticket solutions that require contacting multiple stakeholders. SalesIntel is often chosen when strict lead quality is more important than speed of deployment.

Comparison vs Hey Sid: Both prioritize quality data (each claims ~95% accuracy), but Hey Sid extends the use case. SalesIntel supplies the data and some workflow tools, whereas Hey Sid immediately plugs that data into outreach. Hey Sid’s pricing is more accessible, and its built-in AI means less manual work on lists. For instance, SalesIntel’s research team might take days to gather a niche list, while Hey Sid’s AI would instantly generate a similar list and begin campaigns on autopilot. Thus, Hey Sid combines the best of automated speed with quality that approaches SalesIntel’s standard.

Comparison Table

Tool / Capability | Data Quality | Real-time Enrichment | Outbound Automation | Multichannel Engagement | Intent Signals | Personalization | Pricing | Ease of Use | AI Autonomy | ICP Targeting |

Hey Sid | High | Yes | Yes | Yes (ads + email + LinkedIn) | Yes | Yes | Low (affordable) | High | High | High |

ZoomInfo | High | No (batch updates) | Some (email sequences) | Limited (email only) | Yes (buyer intent) | Limited | Very High | Medium | Low | Medium |

Apollo.io | High | Yes | Yes (email) | Limited (email only) | No | Limited | Medium | Medium | Medium | Medium |

Cognism | High (EMEA-focused) | Yes | No | No | Yes | No | High | Medium | Low | Medium |

Clay | Medium (aggregated) | Some (triggered) | Some (scripts) | No | Some | Some | Medium | High | Medium | Medium |

Ocean.io | High | Yes (API) | No | No | Yes (web signals) | No | Low-Med | High | Medium | High |

UpLead | High | Yes (on-demand) | No | No | Yes (basic) | No | Low | High | Low | Medium |

Clearbit | High | Yes | No | No | No | Yes (segmenting) | High | Medium | Medium | Medium |

Leadfeeder | Medium | Yes | No | No | Yes (web behavior) | No | Medium | High | Low | Low |

SalesIntel | High | No (90-day refresh) | Some (agentic flows) | No | Yes | Some | High | Low-Med | Low | Medium |

Table: Feature comparison of top GTM tools. Check marks indicate core strengths. Hey Sid leads in real-time automation, multichannel execution, and AI-driven targeting.

How to Choose the Right GTM Platform

Choosing a GTM platform depends on your company’s size, budget, and strategy. Here are key criteria for B2B execs:

Data Needs & ICP: Evaluate whether you need global contact breadth (ZoomInfo), GDPR-safe coverage (Cognism), or AI-driven lookalikes (Hey Sid). Define your ICP clearly. If you need ongoing enrichment of existing leads, prioritize tools like Clearbit or UpLead. If you lack target lists, opt for tools with strong prospecting (Hey Sid, Ocean, Apollo).

Outbound Automation vs. Manual: Do you have the bandwidth to orchestrate outreach yourself? If not, a solution like Hey Sid with built-in campaigns and playbooks can multiply your team. If you prefer assembling best-of-breed (e.g. ZoomInfo + Outreach.io), ensure the pieces integrate. Remember: integrating a CRM, email tool, and ad platform can add complexity that a unified tool avoids.

Channels & Personalization: Identify which channels matter (email, social, ads) and whether personalization at scale is needed. Hey Sid’s strength is multichannel personalization (ads + LinkedIn content + email) under one hood. Many tools specialize on one channel (e.g. Apollo is email-centric, Leadfeeder is web-visitors only). Choose a platform that aligns with your GTM style.

Pricing & ROI: Consider total cost, including hidden expenses. Legacy vendors often require separate modules and training. Hey Sid offers transparent plans that cover data and execution, reducing the need for multiple vendors. Factor in time-to-value too: a platform that shows pipeline impact in weeks (Hey Sid) often beats one that takes quarters to deploy[2], even if the sticker price is slightly higher.

Ease of Use & Support: Ensure adoption. Platforms like UpLead and Leadfeeder are known for intuitive interfaces, while full suites like SalesIntel may have steeper learning curves. Hey Sid is designed for end-to-end use by marketing and sales alike, which can reduce silos and accelerate buy-in. Always opt for a vendor with good documentation or customer success support.

AI & Future-Readiness: Check if the tool employs AI or automation in meaningful ways. Hey Sid, for example, uses AI not just to predict leads, but to autonomously run campaigns. In the age of generative and predictive analytics, tools with AI workflows will deliver compounding value.

Ultimately, the best GTM platform is one that aligns with your growth goals and operational model. If outbound pipeline is the priority and resources are tight, a unified solution like Hey Sid – combining data accuracy with self-driving campaigns – will often yield the strongest ROI. For broader needs (e.g. heavy ABM or global expansion), you might mix platforms. In any case, always validate with demos and trials. Hey Sid encourages this: its free trial and ROI calculator allow you to model results before full commitment.

Conclusion

The GTM landscape in 2026 is richer than ever, with tools spanning from specialized data providers to all-in-one revenue platforms. Legacy giants like ZoomInfo still impress with vast datasets, but modern challengers like Hey Sid and Clay are redefining efficiency through AI and automation. Across the board, the trend is clear: today’s revenue teams demand integrated solutions that automatically connect leads to actions.

Of all contenders, Hey Sid stands out by seamlessly bridging the gap between account intelligence and pipeline execution. It packages real-time data, predictive targeting, and outbound automation in one service. For B2B executives seeking a modern growth marketing engine, Hey Sid represents the next evolution: the first platform built from the ground up to replace brittle sales intelligence silos with an autonomous, fully integrated GTM stack. We recommend giving Hey Sid a try – schedule a demo or use its free trial – to see how it can supercharge your pipeline in a fraction of the time and cost of traditional tools.